Bad Credit: Understanding The Basics

Bad Credit: Understanding The Basics Many people have heard of bad credit, but some may…

Bad Credit: Understanding The Basics Many people have heard of bad credit, but some may…

Credit Repair Advice: How To Improve Your Credit Score Our credit scores determine much about…

Credit Score Repair – The Higher Your Score, The Better For Your Credit Credit score…

If you happen to be one of those with a low credit score, don’t worry…

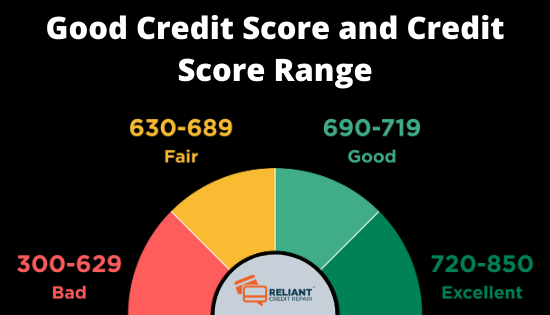

What is a Good Credit Score and Credit Score Range? Credit Report and Credit Score…

Throughout your life you’re the history of your credit repayment will follow you. Ensuring, therefore,…

How To Get A Free Credit Report & What It Means To You If you…

Just Click And Start Your Credit Repair With Bad Debt Personal Loans Online Searching bad…

Staying in contact with your payments each month can help you avoid bad credit. If…

Five Tips For Building A Good Credit Score Improving yourself is always a good thing….

Get Social